10 Oct 2000 | by Stephen Heins

Robert Pitofsky,

Chairman Federal Trade Commission

William Kennard,

Chairman Federal Communications Commission

Dear Sirs,

An ex parte filing from me containing a written copy of the terms and conditions that Time Warner has offered to unaffiliated Internet Service Providers across the country should appear today in the public record at the Federal Communications Commission. I am writing to you to publicly state the concerns that have led me to place this document in the record.

First, I would like to introduce my company to you. NorthNet, an Oshkosh, Wisconsin-based ISP, began operations 4 ½ years ago with 7 customers. Since that time, we have grown to approximately 2500 dial-up subscribers and hundreds of customers who use us for Web hosting. Web site design ASP (application service provisioning) solutions. telecommunications advice, etc. Like so many small to medium sized ISP’s, we have acted as midwives and nannies to a whole new generation of Internet users. In fact, we have provided a wide range of Internet education, tech support, and customer service for residential and business Internet consumers throughout our part of Wisconsin.

In addition, we are the proud sponsor of many community services and activities in our part of the world We work very closely with the following organizations in our area: The Boys and Girls Clubs of Wisconsin, Big Brother-Big Sister, the Oshkosh Seniors’ Center, the Oshkosh Public Library, the Oshkosh Public Museum, the Grand Opera Foundation. the University of Wisconsin-Oshkosh to mention a few. I suspect that our story is no different than the 7,000 or so ISP’s throughout the United States.

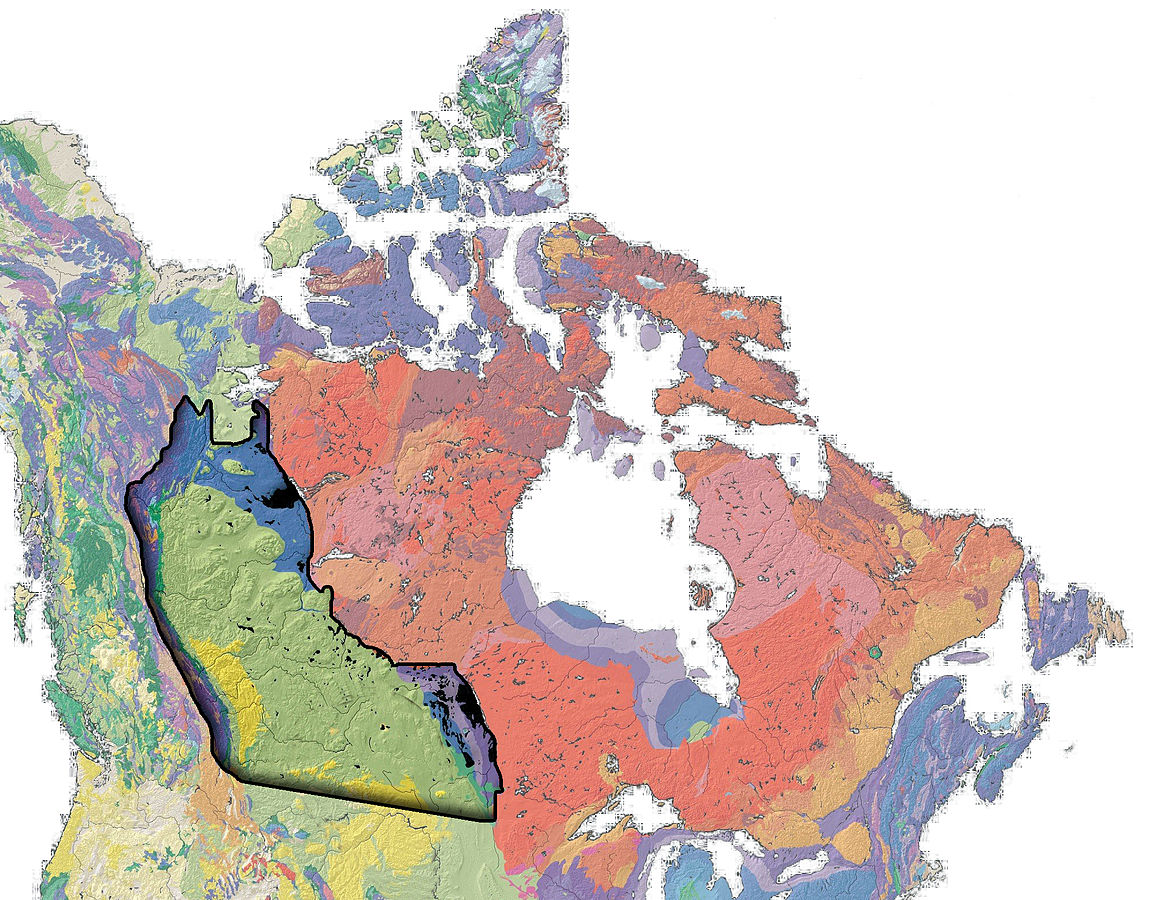

Now, because the cable industry has been able to develop High Speed Internet (HSI) access over their cable lines, they stand poised to rub us out. Why is this so, you may ask? Well, I think one could say the very legislation (the Telecommunication Act of 1996) that helped create the principles of Open Access to telephone lines for ISP’s like NorthNet did not anticipate the evolution of the ‘telecommunication services” now being offered by cable companies like Time-Warner/AOL and AT&T. With the preservation of their closed architecture, these giant corporations now control as much as 90% of all high speed Internet connections to residential customers in the U.S.

In this monopolistic scenario, the most recent round of double talk from AOL Tune Warner on open access only underscores the need for the Federal Trade Commission and the Federal Communications Commission to impose legally binding requirements to provide nondiscriminatory access to broadband Internet communications services. The process and substance of this episode repeats a pattern of foot dragging and delay that has kept these systems closed for more than two years.

PROCESS

Two years ago the cable TV industry insisted it should be allowed to provide broadband Internet communications services on the same closed proprietary basis it provides cable TV service. Seven months ago, with its merger under fire, AOL Time Warner made very public promises in their Memorandum of Understanding (MOU) to negotiate access with ISP•s on the basis of certain principles. Unfortunately, Time Warner’s most recent proposal is, at best, an ever so slightly modified version of the original closed proprietary plan.

Given the cable industry business model and original intentions, this is not surprising. What should be surprising is the fact that Time Warner would send out this Term Sheet in the midst of the intensely scrutinized merger review. Imagine what it will do after the spotlights are off. Simply put. there is no hope for nondiscriminatory access to the broadband Internet through cable moderns without a binding obligation to provide open access. The independent ISP community has recognized this and that is why so many of use have come forward, at great economic risk, to voice om concern.

AOL Time Warner claims that the rates, terms and conditions offered by Time Warner to independent Internet Service Providers (ISP’s) was only a negotiating position. They are now ready to talk more. You can well imagine that independent ISP’s were taken aback when confronted with a Term Sheet that violated the fundamental elements of the MOU promises. How can good faith negotiations take place on such a basis? Moreover, the very first paragraph of the term sheet states explicitly that Time Warner is not bound to deal with ISPs in good faith.

Except for the provisions of Section 21 [confidentiality] of this Term Sheet, this Term Sheet is not intended to create any rights for, or impose obligation upon, either party, including without limitation any obligation to negotiate in good faith.

Let me point out that the first paragraph of the Memorandum of Understanding issued on February 2911a, 2000 states that

it is the intention of the parties to enter into as quickly as possible a binding definitive agreement to provide broadband AOL service on Time Warner’s cable systems, which will be used as a model for the commercial agreements that will be available to other ISP’s.

Is this Term Sheet the model agreement that AOL has signed with Tune Warner? If not, and there were further negotiations, why wasn’t that model put on the table? I wonder if this is the basis on which AOL is willing to deliver broadband Internet service to customers as an unaffiliated ISP on the cable systems it does not own? I suppose that both of your agencies have seen the actual Term Sheet AOL and Time Warner have signed. I am certain that if we had not gone public, there would not have been any movement on their part.

Before I turn to substantive problems in the Term Sheet there is one more point about the process I would like to make. Before an ISP even received the Term Sheet it had to go through two other hoops. First, it had to “pre-qualify.” That is Time Warner insisted that it be given a great deal of information before discussion started. Moreover, the pre-qualification letter made it clear that the ISP’s did not have any right to interconnect, rather Time Warner was picking and choosing who would go on its systems.

We received your e-mail on August 1, 2000 [my first request for access information was sent March 27th, 2000] and may be interested in working with you to offer your internet [sic]service over our broadband cable systems. It would be helpful to us, to determine if you might be a good fit, if you would provide us with some basic background information regarding your company.

- Time Warner areas that you wish to serve; we would expected [sic] you to provide facilities to the Time Warner Cable headed in those areas.

- General information about your company:

- Product offering

- Are you currently offering any broadband services

- Number of subscribers currently served

- How long in business

- Ownership of company

- Basic financial information

- Current service areas

(emphasis added)

You should be able to understand the hesitance of ISPs to provide information about services, subscribers, and service areas to a competitor as a precondition of negotiating access. This letter was followed up with a non-disclosure agreement, which though not uncommon, was extremely onerous. Combine that with a Term Sheet that excuses the offerer from “negotiating in good faith” and contains the outrageous terms and conditions described below, and you will understand why many ISPs are convinced this voluntary process is going nowhere. This context should help you understand why many believed the Term Sheet was not the start of negotiations, but the end and why the ISP community felt compelled to go public about this outrage.

DISCRIMINATION

The MOU was very short on details, but it did declare a series of principles that we think were violated by the Term Sheet.

The terms of the commercial agreements between AOL Time Warner and ISPs wishing to provide broadband service will not discriminate on the basis of whether the ISP is affiliated with AOL Time Warner.

Entry into cable’s High Speed Internet Access: According to the Term Sheet, NorthNet will be required to give an essentially nonrefundable SS0,000 deposit to Time Warner for their promise to allow us access to their cable lines. This is a very expensive pre-condition to a very expensive process: By the time NorthNet has contracted for the necessary infrastructure at Time Warner’s head-end and the transport and backbone services, we will have committed as much as $700,000 before we are able to acquire our first cable Internet service customer.

The home page: Then there is the home screen, which is of course one of the most important starting points for all customer relations on the Internet. The Term sheet mimics the words of the MOU, but then contradicts them.

ISP will have sole control of, and responsibility (including without limitation editorial and technical responsibility) for the homepage for the Service, provided however that (a) the home page will be subject to TWC’s approval; and (b) at all times during the term of the Definitive Agreement there will be a dedicated availability of prominent above-the fold areas on the home page of the Service for use by the Operator at its discretion, but which may, without limitation link to content, applications, service and functionality by such Operator.

Think for a moment about the tilted competitive playing field that Time Warner is seeking to create. Their ISP gets to be in the middle of my homepage, but mine does not get in the middle of theirs. I compete with them for eyeballs, but they get to look over my storefront and approve it. They also get to advertise prominently in it. Every time I win a customer from them, they get to advertise their competing services and sell it to that customer, right in my shop.

Control of the customer relationship: The Term Sheet also places the unaffiliated ISP at a disadvantage to the affiliated ISP in one of the most important aspects of the customer relationship, control over sensitive information that flows between the ISP and the customer.

TWC shall use reasonable efforts to comply with ISP’s customer privacy policy practices, provided, however that to the extent ISP’s privacy policies are inconsistent with, and in some way a limitation on TWC’s current and anticipated business use of such information, ISP agrees to take whatever action necessary to modify its policies with respect to conform with TWC’s business practices.

As a practical matter, Time Warner has control over the information that flows between the customer and the ISP. Time Warner does not intend to allow this information to flow as mere bits. It wants access to the information content of those bits. The gathering and use of customer information is subservient to Time Warner’s business plan. If an ISP wants or successfully builds a business on privacy policy and Time Warner does not like it, it can force the ISP to abandon that business.

The Term Sheet does not stop at asserting control over privacy policy. It inserts itself into my business in a number of other ways that are unacceptable to any independent businessman. Time Warner asserts the asserts the right to sell my service and, perhaps set the price, as well as when to terminate the service.

Each of ISP and TWC will sell the Service and will determine the pricing of the Service when sold by it.

TWC will have sole discretion over Subscribers termination policies include without limitation for non-payment.

Time Warner clearly is not contemplating independent entities using and paying for the use of the network. it is treating all ISPs as subsidiaries to whom it can dictate fundamental business practices. I wonder if Time Warner would give me the right sell, set the price, use the information, and terminate cable TV customers?

STREAMING VIDEO

Video streaming has received an immense amount of attention not only because it might compete directly with the cable TV product. but also because it embodies the qualitative leap in-functionality and quantum jump in speed that broadband Internet provides

The MOU said the following:

AOL Time Warner will allow ISP’s to provide video streaming. AOL Time Warner recognizes that some consumers desire video streaming, and AOL Time Warner will not block or limit it.

Again, the Term Sheet mimics the words of the MOU but immediately contradicts them.

Video streaming and telephony will be permitted as part of the Service, subject to the following provision:

TWC will not be required to provide QoS support for telephony or video streaming for the Service. QoS may be provided upon request and at an additional cost.

To the extent ISP wishes to offer any functionality as part of the Service which (a) is outside the scope of the Network Architecture; or (b) requires an Operator to acquire equipment or software or implement a change in the way the Operator processes, TWC shall have the right to approve such functionality, provided however that in the event TWC approves such functionality, ISP shall be obligated to reimburse for TWC its direct, out of-pocket costs in implementing such new functionality.

Video streaming is foreclosed as a threat to Time Warner’s services without Quality of Service guarantees. Time Warner asserts complete control over video streaming by controlling the economic terms on which Quality of Service is offered. It can define the functionality to prevent competition. Further, to the extent that an ISP develops or deploys facilities that enhance its video streaming capability, which Time Warner feels is “outside the scope of the Network Architecture,” Time Warner wants a right of approval, even if it does not impose a cost on Time Warner. It gets to control the video competition.

Time Warner goes on to build a wall around the video market with pricing policy that dissuades ISPs from competing for the Internet business of cable TV customers. Time Warner buttresses that wall with a marketing barrier and a service quality barrier that can further dissuade ISPs from competing for TV customers. The Term Sheet states

TWC shall retain seventy-five percent (75%) of gross service subscription revenues and ISP shall receive twenty-five (25%) thereof.

Notwithstanding the foregoing, for subscriptions to the lower tier service:

(a) TWC shall receive a minimum monthly payment of $30 for each subscription sold by ISP to existing TWC cable television service subscribers.TWC may package the Service with TWC’s other services.

The Service will be optimized for the personal computer, but the parties understand that the Service may be capable of working on another device if so connected by a customer. TWC’s obligations under the Definitive Agreement will be limited to a customer’s use of the Service through a personal computer.

By singling out current cable TV customers for an extremely high floor price for independent ISP broadband Internet service, Time Warner is leveraging its monopoly position in cable into the broadband Internet market. Given current pricing, Time Warner makes it less profitable for any unaffiliated ISP to compete for the broadband Internet service business of Time Warner’s cable TV customers who have not yet taken broadband Internet service.1 Moreover, placing a price floor under what the ISP must pay Time Warner for any cable TV customer that takes broadband Internet service subjects them to the constant threat of price squeeze.

Bundling broadband Internet with cable is reserved for Time Warner. Time Warner gives consumers a discount when it sells a customer both. ISP’s do not get a discount if the customer takes both.

Under the service quality conditions, Time Warner can design its network to provide higher quality to the set top/TV set than the PC and still claim not to be discriminating against PC-based applications. Its recent filings indicate that it does not envision being obligated to implement nondiscriminatory access in the set top/TV product space.

COMMERCIALLY REASONABLE TERMS

Beyond the question of whether the Term Sheet violates the MOU is the broader question of whether the terms will allow independent ISPs to deliver service on a commercially viable basis.

Impairing the home page and walling off the cable TV market seriously diminishes the attractiveness of entering this market. In addition to taking at least 75 percent of the subscription revenues, AOL Time Warner takes 25 percent of all ancillary revenues generated by the ISP for ••advertising, transactions, communications, premium services, e-commerce, web hosting, and other fees.”

To add insult to injury, while Time Warner as the Operator gets 25 percent of my ancillary revenues, “all revenues generated by the Operator in connection with the Service and whether or not through the Service Home Page (including advertising, transactions, communications, premium services, e-commerce and other fees and service revenues) will be retained by TWC. While my service is running on a PC, Time Warner can generate revenues ancillary to my service on its ITV product, and it gets to keep it all. When l generate similar revenues, I only get 75 percent.

Many independent ISP’s have concluded that these terms present no reasonable basis for independent ISP’s to compete on a commercially viable basis. The MOU was interested in getting “partners” and the pre-qualifying letter talks about making “a good fit.” There is no intention or possibility of allowing competitors onto these networks under these terms. By offering terms that are totally unacceptable, Time Warner keeps its network effectively closed.

Moreover, claims by the in-house cable ISP’s that this is all they get are not a valid test of nondiscrimination. Because all broadband internet service over cable systems is sold today on an exclusive basis by ISP’s that are largely owned by cable operators, their claim simply ratifies anti-competitive transfer pricing. Cable operators lose nothing by establishing excessive prices for the use of facilities, since it all ends up in the same pockets. Onerous conditions for content that prevent competition for video serves the interest of the cable company owners of the affiliated ISP’s.

One place where the Term Sheet is faithful to the MOU is in refusing to allow independent ISP’s to offer services until after the current exclusive contract expires. This time lag would ensure Time Warner that it would capture the vast majority of the first generation of broadband Internet customers on an exclusive basis. With the most attractive customers in hand, and a host of sticky features and switching costs imposed customer, it will have a huge leg up in any future competition. Delaying competition further undermines the prospects that it will be workable.

What we have experienced in the past seven months are .not good faith commercial negotiations, but instead it is the classic response of a monopolist pricing policy. The goal is to placate policymakers like yourselves in the middle of a high visibility regulatory proceeding, without losing control over the marketplace. We know what will happen after the merger is approved, if there is no binding legal obligation to provide open access. Time Warner will go back to that term sheet or some variant of it that restricts head-to-head competition with their products in both the cable TV the broadband Internet product space.

Leo Hindery, former cable executive for TCI and then AT&T, identified the problem for cable companies and government regulators in an interview for CNET News back on April ism. 2000. In spite of the fact that he owned approximately 4 million shares of AT&T at the time, Mr. Hindery stated that

open access is the sine qua non [essential element] to a responsible relationship with regulators as well as consumers. And any appearance or action that is contrary to that is grossly inappropriate. The Internet’s strength is its openness, its non-discriminatory nature. And no one should be precluded by gatekeepers from having their content readily available to all customers. It’s bad business. It’s bad customer relations, and I think it may in fact be unethical.

The only beneficiaries of the FCC’s current laisez faire policies toward the closed architecture of cable companies have been cable companies who are selling their cable subscribers to larger cable companies and content providers who are selling proprietary content to the same large cable companies. Therefore, I am asking you to re-orient the industry toward the same type of open competitive market that has created the remarkable success of the Internet.

Sincerely,

Stephen A. Heins

Director of Marketing

NorthNet

311 Park Plaza

Oshkosh, WI 54901