Thought Piece

Since 2009, the U.S. hydraulic fracturing revolution has caused America to become the world’s top natural gas producer passing Russia, and the top producer of oil and petroleum hydrocarbons since 2014, passing Saudi Arabia. By now almost everybody knows that. Less understood is the role that energy exports are now playing in sustaining U.S. production despite lower prices. In 2015, Congress lifted the 40-year ban on U.S. crude oil exports are rising in some weeks to more than one million barrels of oil per day.

It is reasonable to assume that once the U.S. develops the necessary infrastructure for liquefied natural gas (LNG) on the Gulf of Mexico, east coast and Oregon, the U.S. exports of LNG to Latin American, European Union and Asian countries will be shipping as much as crude oil, another million barrels a day, or even more.

All without money, technical advice or excessive regulation from Wash DC. Steve

Lessons of the Energy Export Boom

Steve Bannon owes Paul Ryan an apology on the oil-export ban.

Wall Street Journal Editorial, June 16, 2017, Bloomsday

Sometimes politics changes so rapidly that few seem to notice. Remember the “energy independence” preoccupation of not so long ago? The U.S. is now emerging as the world’s energy superpower and U.S. oil and gas exports are rebalancing global markets. More remarkable still, this dominance was achieved by private U.S. investment, innovation and trade—not Washington central planning.

Thanks largely to the domestic hydraulic fracturing revolution, the U.S. has been the world’s top natural gas producer since 2009, passing Russia, and the top producer of oil and petroleum hydrocarbons since 2014, passing Saudi Arabia. By now this is well known.

Less appreciated is the role that energy exports are now playing in sustaining U.S. production despite lower prices. Since Congress lifted the 40-year ban on U.S. crude oil exports in 2015, exports are rising in some weeks to more than one million barrels of oil per day. That’s double the pace of 2016 when government permission was required, according to a recent Journal analysis of U.S. Energy Information Administration (EIA) data.

The U.S. still imports about 25% of petroleum consumption on net, mostly from Canada and Mexico, but lifting the ban has resulted in a more efficient global supply chain. Most domestic refineries are configured to process heavy crudes, but fracking tends to produce light sweet crudes. Exporting the light and importing cheaper heavy oil results in lower prices for gasoline and other petro-products, and the larger world market has allowed U.S. drillers to revive production after prices fell from close to $90 a barrel in 2014.

Then there is the surge in liquefied natural gas (LNG) exports. Since the first LNG shipment from the lower 48 left a Louisiana port in 2016, the EIA expects exports will climb by about 200% over the next five years.

What is responsible for this progress? Well, producers are responding to a modest recovery in commodity prices after the price bust amid rising demand, and break-even costs for production continue to fall as technology and cost-management improve. But better policy decisions have also been crucial.

Under federal law, natural gas exports must be certified by the Department of Energy as “consistent with the public interest,” whether the U.S. has a free-trade agreement with the destination country or not. DOE approval is also necessary to build liquefied natural gas export terminals, and the Obama Administration slow-walked these licences until deep into the second term.

Yet starting in April, Energy Secretary Rick Perry approved a burst of LNG projects and promised to speed review of some two dozen other export terminals. In May the rhetorically trade-averse Trump Commerce Department signed a market-access pact that welcomed China to receive U.S. liquefied natural gas shipments and make long-term LNG contracts with U.S. suppliers.

This wave of American LNG is already moving the global market toward a single price, like oil. As long as pipelines were the only transportation option, outfits like Gazprom were able to force their customers to take gas at inflated prices. Increased competition and energy diversification in Europe, where 14 NATO countries now buy 15% or more of their oil and gas from Russia, will also decrease Russia’s leverage as the region’s dominant producer.

As for the oil-export ban, this policy triumph arrived as part of a compromise between Republican leaders in Congress and the Obama White House in the 2015 budget deal. The GOP had to extend green-energy subsidies for several years as the price of Mr. Obama’s signature, but opposition from the left to any exports was certain to grow. GOP leaders recognized that a policy victory established by statute was worth the trade, and they are being vindicated now as exports grow with dividends for U.S. workers and energy production.

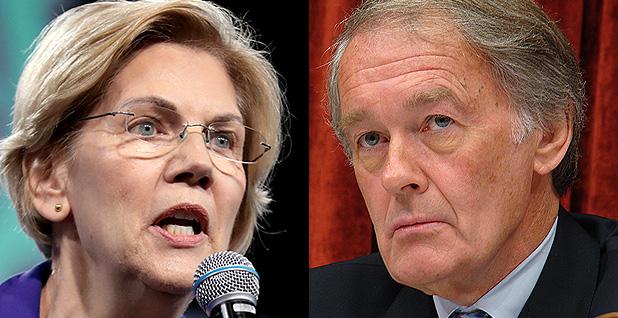

Conservative critics at the time didn’t take the long view, to say the least. The Heritage Action pressure group instructed Congress to vote against the compromise, saying it “fails to achieve significant conservative policy victories.” Steve Bannon and Julia Hahn, now White House aides, wrote a Breitbart.com manifesto “ Paul Ryan Betrays America,” calling the bill “a total and complete sell-out of the American people.” Opposition was concentrated among Republicans: 95 Representatives and 35 GOP Senators voted nay, but Democrats didn’t get the better of the deal.

All of this is a lesson in free-market energy policy but also the occasional wisdom of accepting partial victory. The last two Presidents—including George W. Bush, President Ethanol—had too much confidence in government to drive energy change. President Trump doesn’t appear to be following their example, and Americans are benefiting as a result.

Appeared in the June 16, 2017, print edition.